Government Profit From Student Loans

Robert Cornell

Writer

According to an article by Rodrique Ngowi, on the Boston Globe website, the Government Accountability Office report stated that the federal government has been profiting an estimated $66 billion from student loans between 2007 and 2012. In a previous report from the Congressional Budget Office, it is stated that the government will continue to profit an additional $185 billion on new student loans that will be made over the next 10 years.

Elizabeth Warren, Senator of Massachusetts, was outraged when she was informed of the numbers. Warren stated, “This is obscene. The government should not be making $66 billion in profits, off the back of our students. This report reinforces what we already knew-instead of investing in our children and their futures, the government is squeezing profits out of our young people and adding to the mountain of debt they will spend their lives struggling to repay.”

Warren has decided that enough is enough. “It’s time to end the practice of profiting from young people who are trying to get an education and refinance existing loans.” She has filed for a “skin-in-the-bill” that is trying to pressure colleges into keeping their costs down for students and ensuring that students get a meaningful diploma when they graduate. The bill also requires that if colleges don’t meet on-time graduation rates and other criteria, they must refund a portion of a student payments.

The biggest issue comes down to the fact that it seems like no one knows where the profits are going, and government officials aren’t talking. Based on information posted by USA Today, “The federal government made enough money on student loans over the last year that, if it wanted, it could provide maximum-level Pell Grants of $5,645 to 7.3 million college students.”

The government is making more profit off of student loans that all but two companies in the world, and from the data published to date there is no proof that the money being made is being funneled back into higher education. What is the money being used for? Shouldn’t the money that the government is profiting off of student loans re-enter the school system, or not be charged at all to reduce the rate of student loan debt?

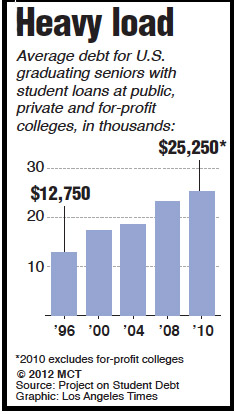

For the class of 2013, the average student has $26,000 in government owed student loan debt, according to CNN. However, overall student debt from college related expenses is closer to $36,000. Based on the chart to the right, average student debt has been on the rise in the recent years, and when combined with rises in the cost of housing, food, electricity, fuel, and other expenses students will face after college, the prospect of ever being out of debt is seeming less and less of a prospect for students, especially when combined with increased competition and unemployment rates in the job market.

Leave a Reply

You must be logged in to post a comment.